One can begin developing financial literacy earlier than you might think. The habits that we establish from an early age and our ability to understand financial concepts—such as opportunity cost and compounding interest— will play a significant role in our financial success story as adults.

The path toward financial freedom looks different for everyone, but implementing the following ideas at an early stage will give you (or your children) a jump start.

Pre-School (for parents):

- Teach children about trade-offs (also known as opportunity costs). Life is determined by the choices we make. Our finances are determined on where we spend and don’t spend our money. When at the grocery store, talk about choices (e.g. we can either buy a name brand box of cereal or two boxes of the store brand variety).

- Introduce the concept of money and how it relates to work. If your children ask where you are going in the morning, explain that you are going to work so that you can work hard to earn money that’s used to pay for things like food, housing and special activities.

- Discuss the difference between needs and wants. It is important to understand that we can’t have everything we want. Consider implementing a system to earn stars, points or dollars that can be used toward the future purchase of a “want” such as a special toy.

School-aged Children (also for parents):

- Establish a system for earning money (e.g. allowance).

- Use mason jars, envelopes or something similar to divide the earnings into four separate categories: spending (50%), saving (20%), college (20%) and giving (10%). Regardless of whether your children attend college, this system will allow them to understand that they do not get to spend every dollar earned. It also introduces the concept of college at an early age even if they later opt to pursue an alternative option.

- Open a savings account to store larger sums of money.

High School:

- Get a part-time job. The act of working does more for a teenager than simply earn money. It teaches responsibility and develops skill sets that can later be translated toward future career opportunities. Working also establishes a work history that will set you apart when applying for colleges and future jobs.

- Begin saving as early as possible. Start saving for future college costs, establish the beginnings of an emergency fund or even invest in a Roth IRA Retirement Account (if you are working and earning an income). All of these savings buckets will create valuable options that can set you up for greater opportunity for financial success down the road.

NOTE: I have never met someone who regretted starting to save early. The value of time works in your favor because of the magic that comes with compound interest. Check out these numbers: if you invest $1,000 a year for six years (age 16-22) in a retirement account that earns an 8% annual return and then save nothing more, you will have over $216,000 when you retire at the age of 65. To clarify, if you invest a total of only $6,000 during high school and college, that $6,000 will be valued at over $215,000 if it is invested properly to earn an annual return of 8% a year. If you invest $2,300 for each of these years ($13,800 total), you will have almost half a million dollars in your retirement account. If the funds are invested in a Roth IRA, all of that money can be withdrawn tax free!

College:

- Consider attending an in-state University to reduce tuition costs. If you’re not set on attending a four-year school initially, attending a community college for the first two years can also make a significant impact on the cost of a four-year degree.

- Apply for scholarships and work part-time. Working part-time in college helps to establish a work history and skill set that’s even more valuable than that from high school. Employers want to hire individuals who know how to work hard. Having the ability to talk about time management involved with working while going to college will ABSOLUTELY set you apart when you are applying for jobs after college.

- Take a course related to personal finance or consider a Business Minor. Regardless of your career interests, business and finance-related courses will introduce concepts that are applicable to working and interviewing in all career fields. Doctors, lawyers, psychologists, freelance writers, etc. all might later start small businesses and a business background can be a game changer for success.

- Manage your lifestyle and avoid credit to finance your social calendar. The cost of a $10 cocktail could cost you more than twice that amount if you use a credit card and hold the balance for a long period of time. The cost of a spring break vacation in Mexico could also wide up costing you more than double the price tag after considering the high interest payments. Consider trade offs before swiping a card. Also consider trade offs with large items such as college housing and transportation.

First Career:

- Get a handle on any unhealthy debt that you might have acquired and develop a plan to get it paid off. Consider working with a financial coach to help you with this if you are unable to manage the process independently.

- Work to establish an emergency fund. The goal is to have 3-6 months of spending saved in a low-interest savings account. This fund needs to be for unplanned events. Establish other savings for anticipated future purchases such as a future vacation, new car, down payment on your first home, etc.

- Contribute as much as you can toward retirement. Contribute the full amount needed to capture your employer plan’s available match. Then look into a Roth IRA. If you are able to contribute more towards retirement, go back to fully fund your employer retirement options such as a 401(k).

NOTE: Your first career will establish a baseline of earnings, savings and thus lifestyle (spending habits). It is extremely difficult to reduce lifestyle expectations once you have established expectations of where and how you live your life. Try to save as much as you can from the beginning in order to reduce the amount that you have available to spend on lifestyle items. Click here to learn more about ways to save more and spend less today.

Your 20s and 30s:

- Conquer the recommendations above: pay-off unhealthy debt, establish an emergency fund and begin to save as much as you can for retirement. You can work on these items simultaneously as the benefits should be weighted differently based on your personal situation.

- Manage your lifestyle. Consider living with roommates. Be responsible with the purchase of any vehicles (buy used vehicles whenever possible). If using a credit card to earn rewards, be sure to pay it off every month to avoid interest.

- Position yourself to earn as much income as possible. Many argue that net worth is not based on what you earn but based instead on what you save. Truth is: earning more will allow you to save more as so long as you manage your lifestyle. Earn more. Spend less. Save and invest as much as you can …. as early as you can.

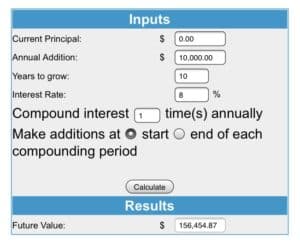

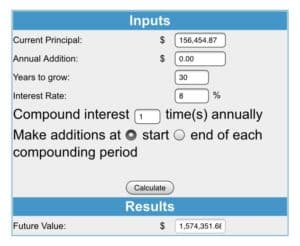

NOTE: If you save $10,000 a year only from the age of 25-35 ($100,000 total over 10 years), at the age of 65 you would have more saved for retirement than someone who saved $10,000/year from the age of 35-65 ($300,000 total over 30 years). The photos below illustrate the results of both options. Assuming an 8% annual return, you would have more than $1.57M saved in the first example compared to $1.22M when you postpone saving until the age of 35. This highlights the value of time and compound interest.

First calculation: starting with $0 invested and contributing $10,000/year for ten straight years earning an annual interest rate of 8%. You will have over $156K in the account, as shown above.

Second Calculation: Take the $156K balance and keep it invested for 30 years (assuming an 8% annual return) with no additional contributions. You will have an account balance of over $1.57 million.

Compare the first scenario with the calculation above that demonstrates the result of waiting to invest until age 35. Start with a $0 balance and invest $10,000 every year for 30 consecutive years at an assumed annual interest rate of 8%, and you will have $1.22 million. To reiterate you will have $350K less even though you invested three times the amount of money ($30,000 vs. $10,000). The difference is the value of time and impact of compound interest.

First-Time Home Buying Considerations:

- Consider your home ownership options. Real estate can be a great way to build wealth and first-time home buyers typically have the ability to purchase a home with less money down.

- Take time to truly consider what you can afford. Just because the bank will qualify you for a specific loan amount, does not mean that it is a wise financial decision. Look at all of the involved expenses when budgeting for a home. This includes more than the down payment, closing costs, principal, interest, taxes and insurance. Be sure to factor in the cost of utilities, home association fees, furnishings, potential repairs and upgrades, cost of commuting changes, and the impact to other monthly contributions such as retirement savings.

- If you are interested in the potential of owning investment properties down the road, look at the opportunity for roommates or consider purchasing a duplex where you can live in one side and rent out the other. The rental income can offset your living expenses or provide additional resources to fund future financial goals such as the purchase of an investment property, retirement savings or even a dream vacation.

- If you have plans to relocate in the semi-near future, consider purchasing a property that could later be used for an investment rental. Just be sure to do your due diligence on the purchasing process.

Building a Strong Financial Foundation: Control What You Can

When working to establish a growing net worth, it’s impossible to predict the future with any real certainly. We are unable to know what the markets will do and thus what return we will see in our investment accounts. We can however control where our money goes (aka cash flow) and manage our lifestyle creep to ensure that we are positioned for as much financial success as possible.

Don’t lose sleep over what you are unable to control but be mindful of the impact of your decisions. Understand that time and compound interest work in your favor, so work to maximize your financial situation to the best of your ability when possible.

Cheers to earning, saving, giving and enjoying all you can.